Transfer pricing documentation requirements and reporting obligations

- Transfer pricing

- 3 minuty

Transfer Pricing: who has documentation and reporting obligations?

If:

- you are a taxable person (subject to corporate income tax or personal income tax), and

- in 2023, you engaged in transactions with related parties, and

- the value of these transactions exceeded the statutory thresholds in 2023,

then you need to determine your transfer pricing obligations and explore tax law for any exemptions you may qualify for.

Related parties – what are they?

The analysis of related parties is a complex and broad topic, as it applies to both corporate and personal income taxpayers. The definitions and types of affiliations are governed by the CIT and PIT Acts.

Related parties are groups of entities that cooperate and engage in transactions or settlements with one another. These relationships can be based on capital / asset or personal connections.

The concept of “exercising significant influence over another entity” is also linked to related-party transactions. But what exactly does significant influence mean?

Transfer pricing regulations define three categories of significant influence:

- through ownership, management, or control links,

- by an individual’s actual ability to influence key decisions,

- through family connections.

Examples of related parties:

- a board member who makes strategic decisions, and a company in which their relative holds 25% of profit-sharing rights.

- a supervisory board member of one company who also serves on the management board of another.

- a company that is not a legal entity (e.g. a general partnership) and its partner.

- a limited partnership or limited joint-stock partnership and its general partner.

- a taxpayer and their foreign permanent establishment.

Remember to carefully analyze the relationships you have identified in intercompany transactions.

Why is the identification of links so important?

Analyzing and identifying relations are crucial for ensuring transfer pricing tax compliance. Incorrect analysis of these relationships can lead to the failure to identify transactions that are subject to documentation and reporting obligations in Polish jurisdiction.

Which transactions should be analyzed?

Polish legislation requires transfer pricing documentation for controlled transactions of a homogeneous nature where the net value exceeds the documentation thresholds for the tax year:

- PLN 10 million – in the case of a commodity or financial transaction;

- PLN 2 million – in the case of a service and other transaction;

- in the case of transactions with haven entities:

- 2.5 million in the case of a financial transaction,

- 0.5 million in the case of a non-financial transaction.

Not only typical service, goods, or financial transactions are subject to transfer pricing obligations. Taxpayers often overlook atypical transactions, such as the provision of gratuitous benefits or changes in share capital.

Remember that transfer pricing obligations apply to all economic activities identified based on the actual behavior of the parties and the terms established or imposed due to their relationship.

Here are examples of transactions that are often overlooked:

- providing a gratuitous service, such as a free loan guarantee or a free license,

- granting a loan to a related party without remuneration,

- conducting capital transactions, such as increasing the share capital of a related entity or subscribing to newly issued shares,

- merging, acquiring, or dividing associated companies.

What obligations do related parties have?

If your transactions with related parties exceeded the materiality thresholds set by the CIT Act in 2023, you must:

- prepare transfer pricing documentation — local file, and, for some entities, master file as well.

- prepare a transfer pricing analysis — unless you qualify for an exemption from preparing the analysis or if there is uncertainty regarding the marketability of the prices used.

- submit information on the transactions to the relevant tax authority (Form TPR) along with a statement confirming the application of market prices.

- verify the obligation to submit a CBC-R / CBC-P notification

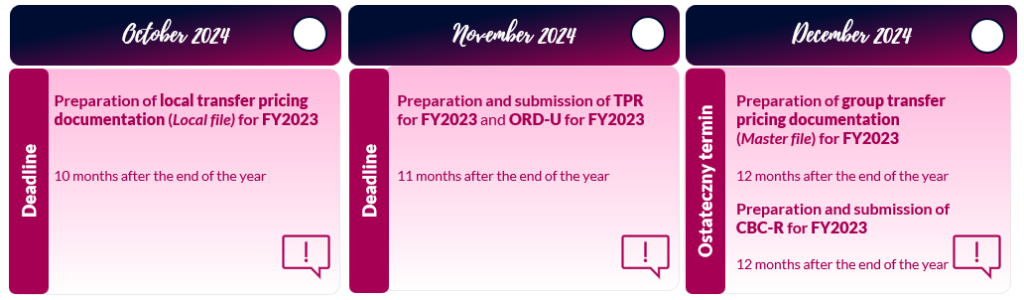

Deadlines for compliance with documentation and reporting obligations for 2023:

Summary

Correctly identifying transfer pricing obligations, documentation requirements and preparing documentation on time is crucial for minimizing tax risks and being safe in case of tax audits.

Need support in analyzing related party transactions? Have questions about documentation and reporting obligations? Get in touch with our experts to get all the answers and explanations.

We will help you prepare documentation that meets statutory requirements and is tailored to your specific business needs.