Transfer Pricing documentation obligations for 2023 - deadlines are fast approaching!

Key deadlines are approaching for:

- Local transfer pricing documentation (Local File),

- Transfer pricing information (TPR),

- Group transfer pricing documentation (Master File).

In 2024, these deadlines will arrive quicker than ever before.[1]

Local File – begin preparing without delay

This is your final call to prepare documentation for related party transactions. You must complete your Local File for the 2023 tax year by October 31, 2024.

TPR – stay aware of deadlines

The deadline for submitting the TPR form for the 2023 tax year (Transfer Pricing Information) is fast approaching: November 30, 2024.

It is essential to prepare the TPR form with the utmost care, as it serves as the basis for authorities when selecting entities for transfer pricing audits. Every detail matters.

The form requires critical information on intercompany transactions, making it one of the most important documents to submit on time. Tax authorities will quickly notice its absence.

Important!

Transfer pricing documentation and reporting obligations may also apply to individuals, as well as to transactions with entities from so-called tax havens, whether related or unrelated.

Master File – the time is now

A taxpayer belonging to a group with a consolidated turnover exceeding PLN 200 million in the previous fiscal year is also required to maintain group transfer pricing documentation (Master File). The deadline for attaching it to the Local File for 2023 is December 31, 2024.

Consequences of failing to meet obligations

Failure to comply with documentation and TPR obligations for FY2023 may result in sanctions, including criminal penalties. Liability extends not only to the taxpayer (which could lead to an overestimation of tax liabilities) but also to individuals responsible for the taxpayer’s transfer pricing, particularly Board Members, though not exclusively. Fines in such cases can reach up to 720 daily rates or as much as PLN 41 million (!).

***

If you have engaged in transactions with related parties or entities from so-called tax havens (e.g. Monaco, Hong Kong) and have not yet fulfilled your transfer pricing obligations for the 2023 tax year, or if you would like to confirm whether such obligations exist, please urgently contact:

| Magdalena Marciniak | magdalena.marciniak@mddp.pl | +48 665 746 360 |

or your advisor from MDDP. Together with the MDDP Transfer Pricing Team, we can support you in identifying and fulfilling these tax obligations.

***

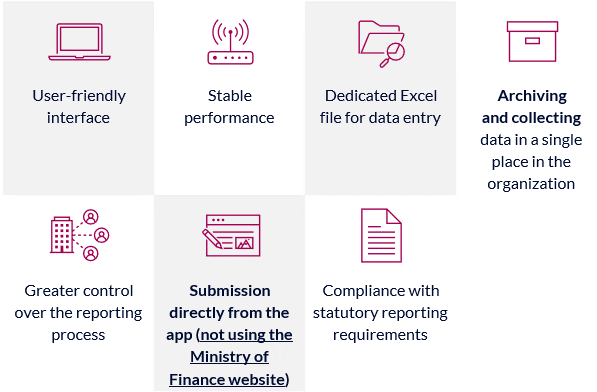

Do you want to fill in the TPR form by yourself? Use our dedicated tool

>>Smart.TPR<<

Smart.TPR app! Self-filing and submission of TPR form

| Adrian Mroziewski | adrian.mroziewski@mddp.pl | +48 505 294 041 |

[1] The deadlines outlined in the Tax Alert apply to entities whose tax year aligns with the calendar year. If your tax year does not coincide with the calendar year, we encourage you to contact MDDP experts to confirm the deadlines for fulfilling your transfer pricing documentation and reporting obligations for FY 2023.

__________________________

This Tax Alert does not constitute legal or tax advice. MDDP Michalik Dłuska Dziedzic and Partners Tax Advisory Joint Stock Company is not responsible for the use of the information contained in the communication without prior consultation with legal or tax advisors.