Polish Deal [Polski Ład] 2.0 - changes in PIT, ZUS social security insurance and NFZ National Healhcare Funds as of 1st July 2022

Amended provisions of the so-called “Polish Deal” have been published in the Journal of Laws.

Some of the changes enter into force already on 1st July 2022, whereas others will become effective on 1st January 2023.

Below please find a summary of the key changes introduced by the “Polish Deal 2.0” from the perspective of tax remitters and taxpayers.

Changes effective as of July 2022

- Tax scale

- The lowest rate in the PIT scale is reduced from 17% to 12%, with the tax reducing amount decreased from PLN 5,100 (PLN 425 per month) to PLN 3,600 (PLN 300 per month).

- The new tax scale will apply to the settlement of income for the entire year 2022, whereas tax remitters will apply it when calculating advance tax payments on salaries paid from 1st July 2022.

2022 PIT scale – as of 1st July 2022

| Tax assessment basis in PLN | Tax amounting to | ||||

| from | to | ||||

| 120,000 | 12% minus tax-reducing amount of PLN 3,600 | ||||

| 120,000 | PLN 10,800 + 32% of the excess over PLN 120,000 | ||||

· Monthly tax-reducing amount – PLN 300 – is due for each month regardless of the amount of income. · Annual tax-reducing amount – PLN 3,600 | |||||

- Elimination of the middle-class relief.

- As of 1st July 2022, the tax remitter (workplace) does not calculate the middle-class relief when computing PIT advances payments.

- The middle-class relief will also not be deducted in the annual PIT return. As an exception, taxpayers who, as a result of the elimination of the middle-class relief, pay higher annual PIT for 2022 (despite the reduction of the PIT rate to 12%) will have the difference refunded. The refund will be calculated by the tax office on the basis of the taxpayer’s annual income.

- Elimination of the mechanism of double counting of PIT advance payments

- The obligation of double counting of PIT advance payments, according to which the tax remitter was supposed to calculate advance payments under the rules binding in 2021 and the rules of 2022, has been repealed.

- If in July 2022 the tax remitter will deduct PIT advance payments according to the “old” rules, it will be obliged to calculate the advance payment once again according to the new rules and return the surplus, if any, to the employee, unless the advance payment has been transferred to the account of the tax office.

- Declaration of intention of joint tax settlement with a child

- The possibility of a joint tax settlement with a child has been reinstated for single parents, subject to additional conditions. Joint tax settlement will be possible for income generated from 1st January 2022.

- Already from 1st July 2022 single parents will be able to provide their tax remitter with a declaration of intention of joint tax settlement with a child. In this case, the tax remitter will withhold advance payments until the end of the year at the rate of 12%.

- Changes in new PIT reliefs for employed persons

- The PIT exemption (up to PLN 85,528 per year) as part of the so-called relief for the young, the relief for return, the relief for 4+ families and the relief for working seniors, will also include maternity benefit revenue.

- The income limit for an adult child will increase (currently at PLN 3,089, it will amount to PLN 16,061.28 in 2022). The higher limit is important from the point of view of:

- deducting the allowance for an adult earning child (up to 25 years of age) in education,

- the possibility of joint settlement of a single parent with an adult child (up to 25 years old) in education,

- taking advantage of the 4+ family relief.

- Increased remuneration of the tax remitter for timely payment of taxes (planned change)

- Right now, the remuneration of the tax remitter for timely payment of taxes to the state budget is 0.3% of the amount of collected taxes.

- The remuneration of tax remitters calculating taxes (advance payments) on income taxed according to the tax scale is planned to be increased to 0.6% of the amount of collected taxes. The draft amendments in this regard, which are to enter into force on 1 July 2022, are still at the consultation stage.

- Changes for freelancers

- Possible partial deduction of healthcare insurance contributions paid for entrepreneurs settling their taxes:

- with 19% flat tax – deduction from income or as a tax cost (deduction up to the limit of PLN 8,700 annually),

- with lump-sum tax on recorded revenues – deduction from revenues (deduction up to 50% of the amount of the contributions paid).

- Right to change of the form of taxation of business income (revenue) to the tax scale applied in 2022 during / after the end of the year:

- taxpayers settling their taxes in 2022 with lump-sum tax may switch to the tax scale taxation already during 2022 by submitting a declaration on resignation from lump-sum taxation by 22 August 2022 – the change of the form of taxation will apply to income generated as of July 2022,

- taxpayers settling their taxes in 2022 with flat tax or lump-sum tax will be able to change the form of taxation by switching to the tax scale taxation by making a declaration as part of the annual tax return for 2022 – in this case, the change of the form of taxation will apply to income generated throughout 2022.

Please note: The change of the form of taxation will also result in the necessity to calculate the healthcare insurance contributions under the rules applicable to the PIT scale taxation.

- Healthcare insurance obligation for commercial proxies

- The provisions relating to healthcare insurance for persons appointed to perform a function under an appointment act receiving remuneration on that account will be clarified by explicitly stating that they also apply to commercial proxies (‘prokurenci’).

- It follows from the substantiation of the amendment, the purpose of this change is not to introduce a new contribution obligation, but only to confirm that as of 1 January 2022, commercial proxies are subject to healthcare insurance.

Some of the changes will take effect as of 1st January 2023

- Declarations / applications affecting calculation of PIT advance payments, including PIT-2

- Currently, the PIT-2 declaration on the application of the tax-reducing amount may be filed by employees. After the changes:

- PIT-2 may be filed also by other employed persons (e.g. contractors, persons performing specific works, members of the management board and supervisory boards, persons employed under managerial contracts), also when they generate income from lease and business activities subject to the PIT scale,

- The taxpayer will be able to submit PIT-2 to maximum 3 tax remitters, indicating that a given tax remitter is entitled to reduce the advance payment by the amount constituting 1/12 of the tax-reducing amount or 1/24 of the tax-reducing amount or 1/36 of the tax-reducing amount.

- The possibility to submit a request to the tax remitter not to withhold PIT advance payments, currently available, among others, to contractors and persons performing specific works, will be extended also to employees. A taxpayer is entitled to submit the application if they anticipate that their annual income subject to the tax scale taxation will not exceed PLN 30,000.

- Employees, who commute to work from other locations, will be able to exempt their employer from the obligation to calculate increased tax-deductible costs.

- The general rules for submitting declarations by employees will be clarified.

- The principle of indemnity of the tax remitter will be introduced if the tax remitter’s understatement or non-disclosure of the tax base resulted from the application of statements or declarations submitted by the taxpayer affecting the calculation of the advance payment.

- General partners in a joint-stock limited partnership [‘SKA’] with a new obligation to make social insurance contributions

- A general partner in a joint-stock limited partnership will also be deemed to be a person conducting business activity for insurance purposes.

- General partners will pay social insurance and healthcare insurance contributions as entrepreneurs, taking into account the concurrence of other social insurance obligations.

- Other selected changes in PIT

- Deadlines for filing annual PIT returns will be unified. For instance, the PIT-28 return will have to be filed by 30 April of the year following the tax year.

- The maximum amount of tax deductions for public benefit organisations transferred in the annual tax return will be increased from 1% to 1.5% of tax.

- The so-called monument allowance will be limited/loopholes in the allowance will be eliminated. Expenses incurred as of 1 January 2023 for the paid acquisition of an immovable monument entered in the register of historic monuments or an interest in such a monument will not constitute grounds for reducing taxable income.

- The possibility to deduct the amount of membership fees paid to trade unions from the tax base will be increased from PLN 300 to PLN 500.

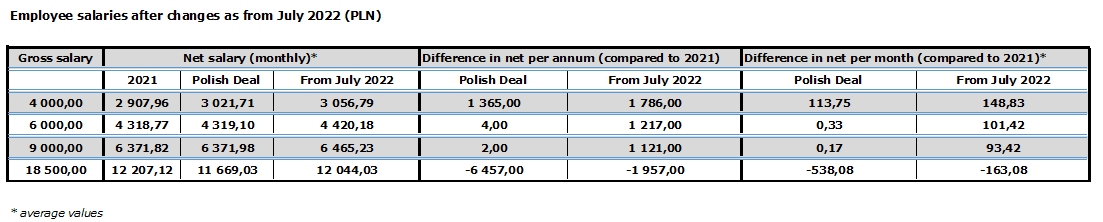

The impact of the Polish Deal 2.0. on employee salaries – an example calculation

*****

If you are interested in the above information and its impact on your business, please contact:

| Anna Misiak | Anna.Misiak@mddp.pl | +48 500 046 024 |

| Rafał Sidorowicz | Rafal.Sidorowicz@mddp.pl | +48 506 788 582 |

or your advisor at MDDP.