The market debt level analysis complements the mandatory benchmarking analysis prepared for financial transactions and concerns the analysis of the debt level of comparable, independent entities in the market.

The analysis encompasses various aspects of intra-group financing to confirm that the taxpayer has the capacity to incur and service its obligations at a level that would be accepted by comparable entities in the market. Depending on the taxpayer’s situation, there are several variants of how the analysis can be prepared.

Who does it apply to?

The market debt level analysis applies to taxpayers receiving or providing intra-group financing in various forms such as loans, credits, deposits, bond issuances, etc. In particular, the analysis is necessary for taxpayers who have identified risks during the completion of our provided free calculator.

Why is it worth conducting the analysis?

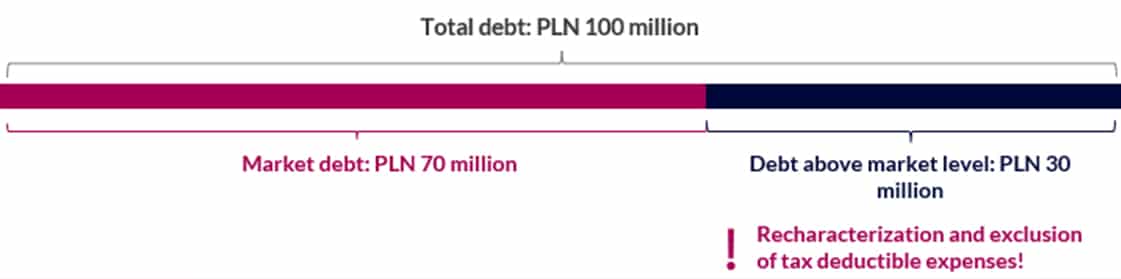

In the absence of an analysis, the tax authority has unrestricted capabilities to conduct verification on its own and, consequently, potentially recharacterize the transaction and determine the estimated tax due.

If the analysis indicates that the taxpayer may not have had the capacity to incur or service the debt at a given level but, for other reasons, the transaction should be considered conducted on market terms, the taxpayer should prepare a Defense File, which also limits the actions of the authorities and serves as evidence of due diligence.

How can you secure your business?

The taxpayer should examine whether they identify risks associated with their intra-group financing – initially, they can do this through our provided free calculator. If, after using it, it turns out that there are risks associated with the financing, we provide support in preparing an individual market debt level analysis tailored to the taxpayer’s specific situation.

In this regard, we offer our support in several variants depending on the needs:

We encourage you to familiarize yourself with the possibilities of conducting the analysis and schedule an individual meeting with our experts

Magdalena Marciniak

Partner | Tax adviser | Head of the Transfer Pricing Practice E: magdalena.marciniak@mddp.pl T: (+48) 665 746 360

Jakub Patalas

Senior Manager E: jakub.patalas@mddp.pl T: (+48) 501 141 923

Natalia Rutkowska

Manager E: natalia.rutkowska@mddp.pl T: (+48) 503 973 338